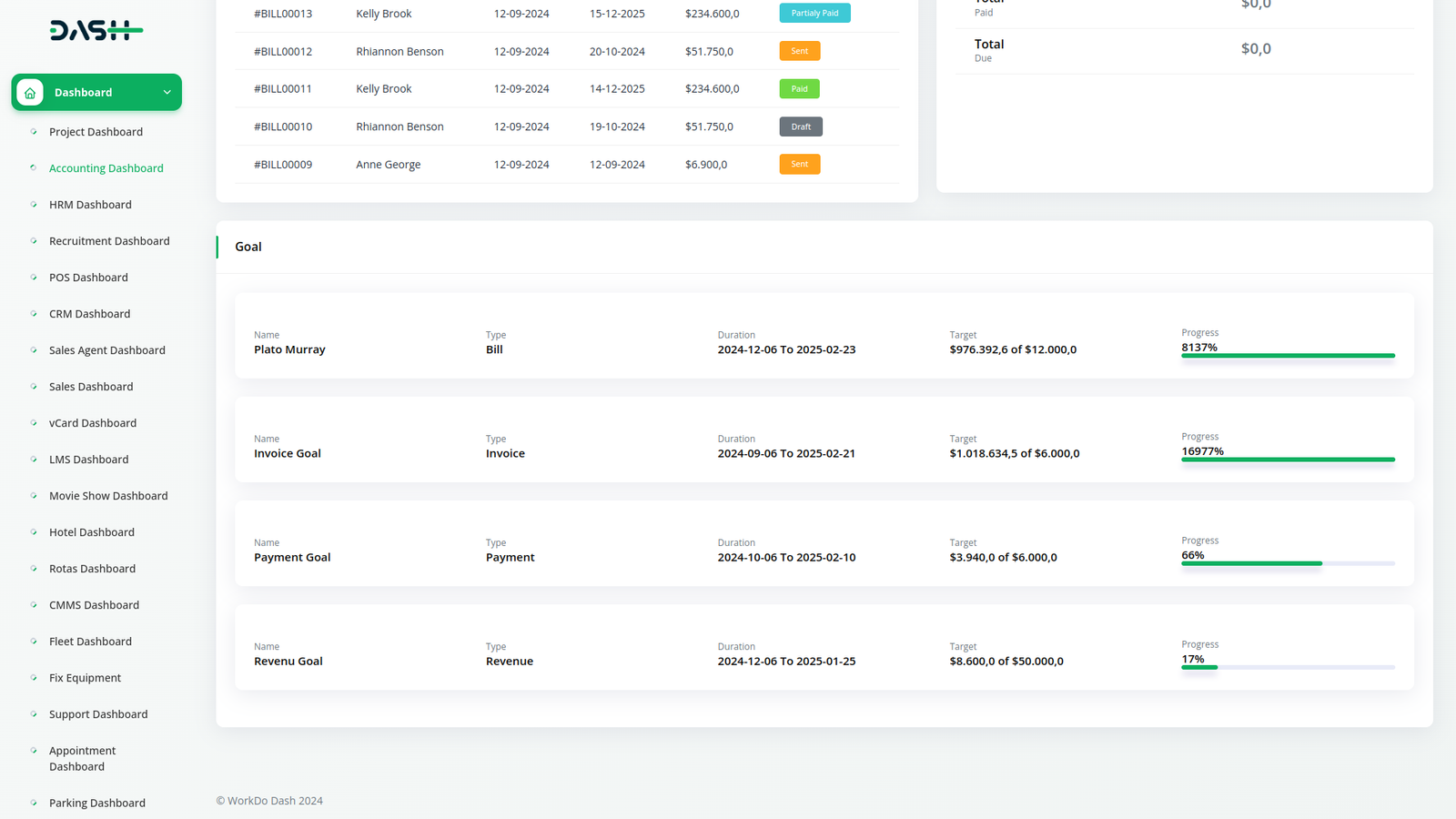

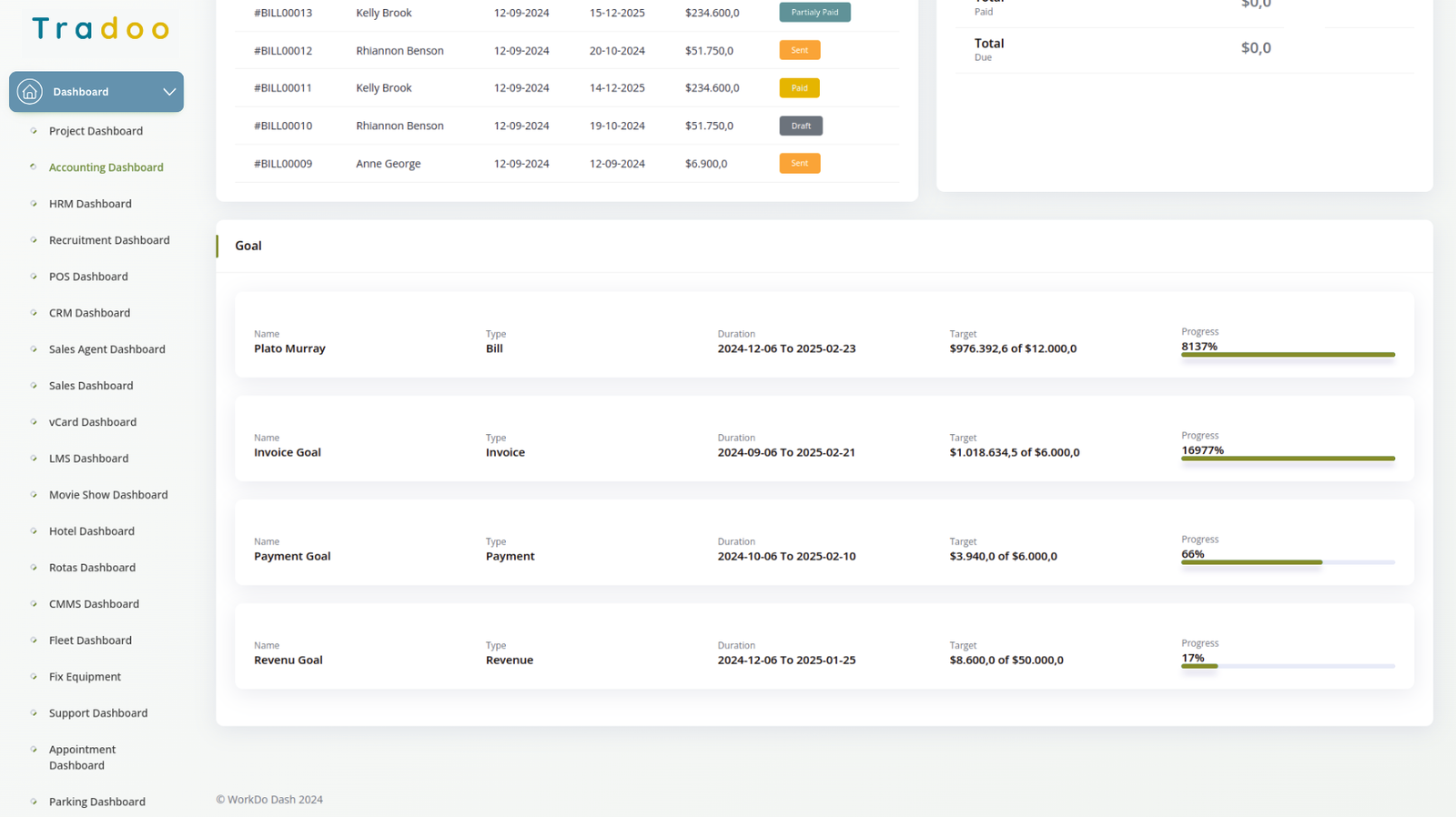

Financial Goal Tracker

Set, monitor, and achieve your financial and business goals with precision. The Financial Goal Tracker—powered by the Accounts Module—helps you measure progress, adjust strategies in real time, and drive sustainable growth through smart insights and actionable analytics.

Setting Financial Goals for Better Money Management

A financial goal defines a specific target for how you manage your money—whether it's saving, spending, earning, or investing. Setting clear financial goals helps you create an effective budgeting strategy, measure progress, and make smarter financial decisions.

What Are Financial Goals?

Financial goals are specific targets you set to manage your money—whether through saving, spending, earning, or investing. They guide your financial decisions and are essential for building an effective and successful budget.

Financial goals are personal milestones—short-term or long-term—that define how you want to save and spend your money. Setting these goals in advance gives you clarity, focus, and a roadmap to achieve what matters most.

Financial goals vary by individual needs and life stages. Some common examples include saving for an emergency fund, buying a home, paying off debt, or investing for retirement. It’s normal to have multiple goals, and they can evolve over time.

Setting clear financial goals helps guide your spending habits and long-term plans. For instance, aiming to pay off debt could motivate you to cut unnecessary expenses and make consistent payments. Without goals, overspending and financial instability become more likely.

Types of Financial Goals

While financial goals vary by individual, categorizing them by time frame helps you prioritize and stay focused. Setting clear deadlines improves planning and keeps you accountable. Most financial goals fall into three categories:

-

Short-Term Goals – Achievable within a few months to a year.

-

Medium-Term Goals – Usually take one to five years to reach.

-

Long-Term Goals – Require five or more years and often involve major financial achievements.

Organizing your goals this way keeps your financial journey structured and manageable.

These are goals you can achieve quickly—within a year. Examples include building an emergency fund, paying off small debts, saving for a vacation, or creating a monthly budget. They set the foundation for long-term financial success.

These goals take one to five years to complete. Examples include saving for a car, planning a wedding, or making a down payment on a home. They often require more strategic saving and disciplined budgeting.

Long-term goals are big-picture ambitions that may take decades to achieve. Think retirement savings, paying off a mortgage, or funding your child’s education. These goals require consistent contributions and a strong financial plan.

Why opt for dedicated modules for your business?

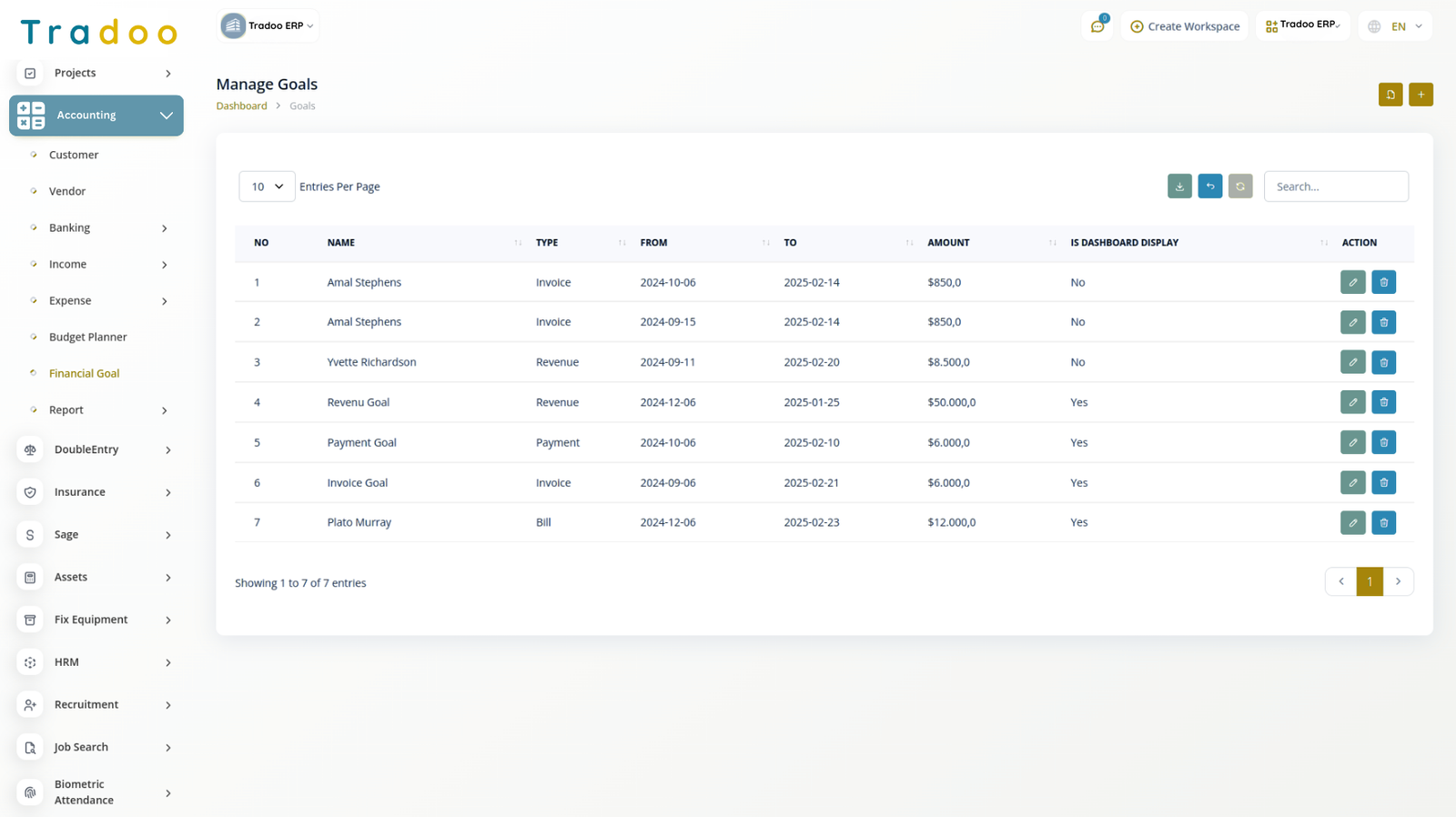

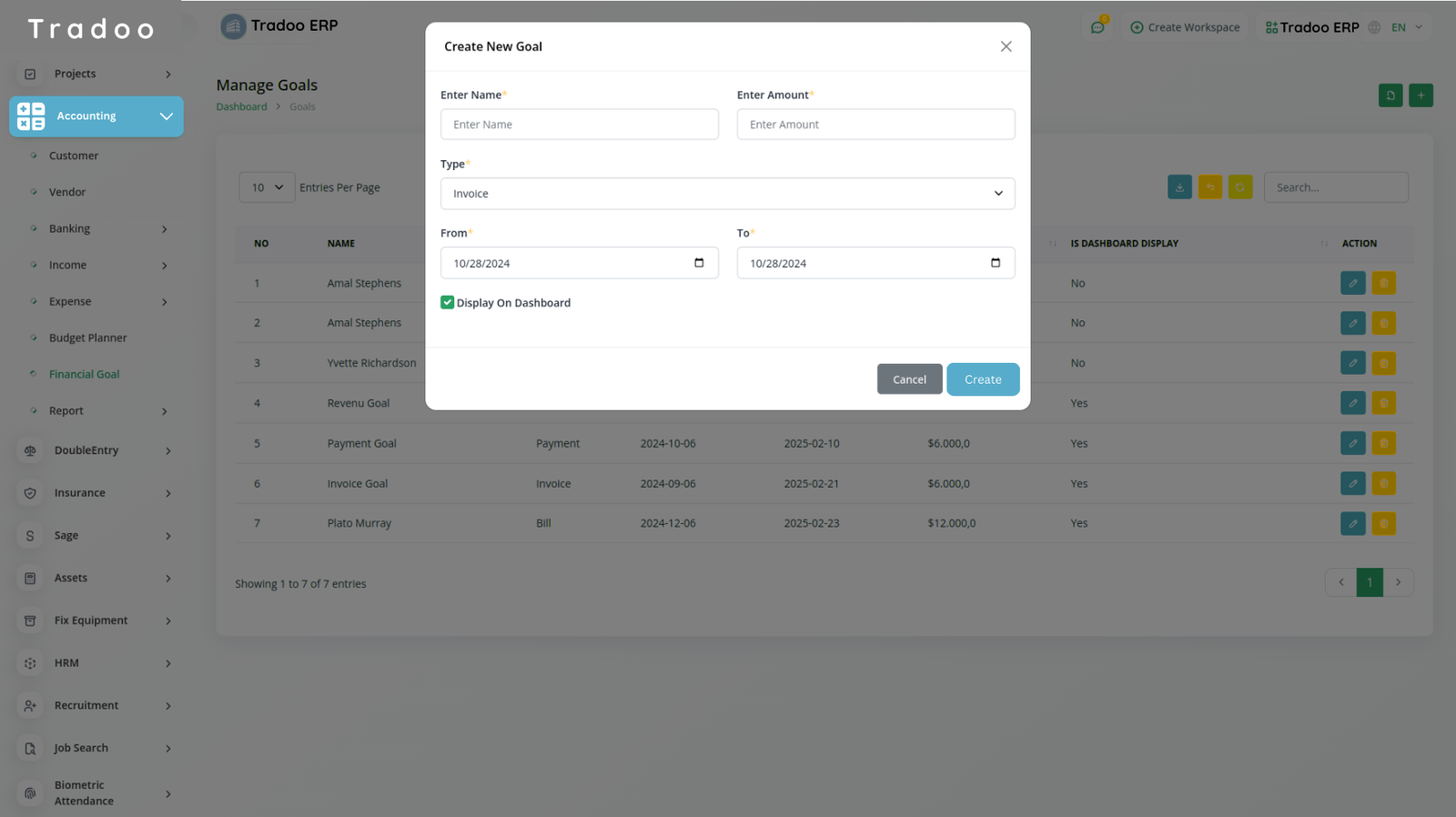

With Tradoo ERP, effortlessly manage all your critical business functions—like Accounting, HR, Sales, CRM, and more—from one smart, centralized platform. No more juggling multiple tools—just streamlined operations, better insights, and faster growth.

Boost Productivity and Efficiency with Tradoo ERP

Unlock powerful features with our premium add-ons. From HR to Finance, Leads to Communication—get everything your growing business needs in one integrated solution. Flexible pricing, full functionality.

- Pay-as-you-go Only pay for what you use—scale as your business grows.

- Unlimited Installation Install Tradoo ERP on unlimited domains or devices, no extra charges.

- Secure Cloud Storage Store your data safely in the cloud with end-to-end encryption and backup support.

Why choose specialized modulesfor your business?

Manage all your core business functions—like Sales, HR, Accounting, Projects, and more—seamlessly from a single, unified platform with Tradoo ERP. Specialized modules help you reduce complexity, boost productivity, and scale smarter.